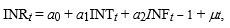

The following regression model was estimated to forecast the value of the Indian rupee (INR) :

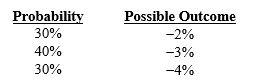

Where INR is the quarterly change in the rupee, INT is the real interest rate differential in period t between the United States and India, and INF is the inflation rate differential between the United States and India in the previous period. Regression results indicate coefficients of a₀ = .003; a₁ = -.5; and a₂ = .8. Assume that INFt - 1 = 2 percent. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:

The expected change in the Indian rupee in period t is:

A) 3.40 percent.

B) 0.40 percent.

C) 3.10 percent.

D) 1.70 percent.

E) none of the above

Correct Answer:

Verified

Q11: Inflation and interest rate differentials between the

Q24: Which of the following is not a

Q25: Factors such as economic growth, inflation, and

Q27: The absolute forecast error of a currency

Q28: The U.S. inflation rate is expected to

Q31: If the foreign exchange market is _

Q32: If the one-year forward rate for the

Q34: Silicon Co. has forecasted the Canadian dollar

Q62: If a foreign country's interest rate is

Q67: If an MNC invests excess cash in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents