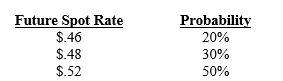

You are the treasurer of Arizona Corp. and must decide how to hedge (if at all) future receivables of 350,000 Australian dollars (A$) 180 days from now. Put options are available for a premium of $.02 per unit and an exercise price of $.50 per Australian dollar. The forecasted spot rate of the Australian dollar in 180 days is:

The 90-day forward rate of the Australian dollar is $.50.

What is the probability that the put option will be exercised (assuming Arizona purchased it) ?

A) 0 percent

B) 80 percent

C) 50 percent

D) none of the above

Correct Answer:

Verified

Q14: If interest rate parity exists, the forward

Q20: The real cost of hedging payables in

Q25: FAB Corp. will need 200,000 Canadian dollars

Q32: Exhibit 11-1 Q33: Since the results of both a money Q35: Lorre Co. needs 200,000 Canadian dollars (C$) Q37: To hedge a contingent exposure, in which

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents