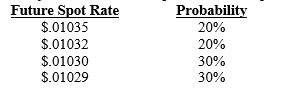

You are the treasurer of Montana Corp. and must decide how to hedge (if at all) future payables of 1,000,000 Japanese yen 90 days from now. Call options are available with a premium of $.01 per unit and an exercise price of $.01031 per Japanese yen. The forecasted spot rate of the Japanese yen in 90 days is:

The 90-day forward rate of the Japanese yen is $.01033.

What is the probability that the call option will be exercised (assuming Montana purchased it) ?

A) 30 percent

B) 60 percent

C) 20 percent

D) 40 percent

Correct Answer:

Verified

Q6: A money market hedge involves taking a

Q8: To hedge a payables position in a

Q21: Linden Co. has 1,000,000 euros as payables

Q29: The price at which a currency put

Q31: To hedge payables with futures, an MNC

Q34: A futures hedge involves taking a money

Q36: If interest rate parity exists, and transaction

Q38: Futures, forward, and money market hedges all

Q48: A _ does not represent an obligation.

A)

Q62: A cross-hedging strategy is most effective with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents