Exhibit 14-1

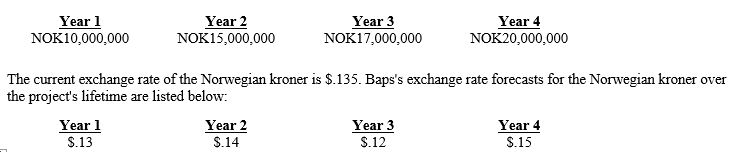

Assume that Baps Corp. is considering the establishment of a subsidiary in Norway. The initial investment required by the parent is $5 million. If the project is undertaken, Baps would terminate the project aFter four years. Baps's cost of capital is 13 percent, and the project has the same risk as Baps's existing projects. All cash flows generated from the project will be remitted to the parent at the end of each year. Listed below are the estimated cash flows the Norwegian subsidiary will generate over the project's lifetime in Norwegian kroner (NOK) :

-Refer to Exhibit 14-1. Baps is also uncertain regarding the cost of capital. Recently, Norway has experienced some political turmoil. What is the net present value (NPV) of this project if a 16 percent cost of capital is used instead of 13 percent?

A) -$17,602.62

B) $8,000,000

C) $1,048,829

D) $645,147

Correct Answer:

Verified

Q1: Fixed costs are expenses that are not

Q6: Assuming that a subsidiary is wholly owned,

Q15: Three common methods to incorporate an adjustment

Q19: The feasibility of a multinational project from

Q36: Petrus Co. has a unique opportunity to

Q37: Which of the following is not a

Q38: The _ is (are) likely the major

Q40: If a foreign project is financed with

Q51: Holding other factors constant, an international project's

Q53: When conducting a capital budgeting analysis and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents