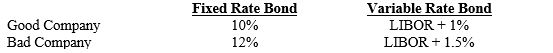

Good Company prefers variable to fixed rate debt. Bad Company prefers fixed to variable rate debt. Assume that Good and Bad Companies could issue bonds as follows:

A) an interest rate swap will probably not be advantageous to Good Company because it can issue both fixed and variable debt at more attractive rates than Bad Company.

B) an interest rate swap attractive to both parties could result if Good Company agreed to provide Bad Company with variable rate payments at LIBOR + 1 percent in exchange for fixed rate payments of 10.5 percent.

C) an interest rate swap attractive to both parties could result if Bad Company agreed to provide Good Company with variable rate payments at LIBOR + 1 percent in exchange for fixed rate payments of 10.5 percent.

D) none of the above

Correct Answer:

Verified

Q8: Lantana Co. pays for many imports denominated

Q10: An MNC issues ten-year bonds denominated in

Q10: Parallel loans are particularly attractive when an

Q12: A callable swap gives the _ payer

Q17: Simulation is useful in the debt denomination

Q18: Floating-rate bonds are oFten issued with a

Q26: New Hampshire Corp. has decided to issue

Q39: A currency swap between two firms of

Q46: A U.S. firm has a Canadian subsidiary

Q47: A U.S. firm could issue bonds denominated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents