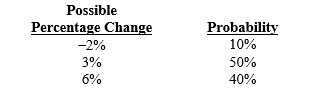

A firm forecasts the euro's value as follows for the next year:

The annual interest rate on the euro is 7 percent. The expected value of the effective financing rate from a U.S. firm's perspective is about:

A) 8.436 percent.

B) 10.959 percent.

C) 11.112 percent.

D) 11.541 percent.

Correct Answer:

Verified

Q10: A risk-averse firm would prefer to borrow

Q10: Assume the U.S. one-year interest rate is

Q16: When an MNC borrows in two foreign

Q17: Assume that the U.S. interest rate is

Q18: The effective financing rate of financing in

Q26: Euronotes are underwritten by:

A) European central banks.

B)

Q27: When a U.S. firm borrows a foreign

Q29: A firm without any exposure to foreign

Q36: Assume that interest rates of most industrialized

Q38: Assume the annual British interest rate is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents