Exhibit 21-1

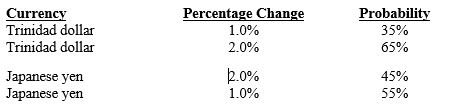

To benefit from the low correlation between the Trinidad dollar and the Japanese yen (¥) , Sciorra Corporation decides to invest 50 percent of total funds invested in Trinidad dollars and the remainder in yen. The domestic yield on a one-year deposit is 8 percent. The Trinidad one-year interest rate is 10 percent, and the Japanese one-year interest rate is 7 percent. Sciorra has determined the following possible percentage changes in the two individual currencies as follows:

-Refer to Exhibit 21-1 above. What is the expected effective yield of the portfolio Sciorra is contemplating (assume the two currencies move independently from one another) ?

A) 6.47 percent

B) 8.84 percent

C) 8.50 percent

D) none of the above

Correct Answer:

Verified

Q9: The effective yield of investing in a

Q10: Since exchange rate forecasts are not always

Q14: An MNC has determined that the degree

Q20: If interest rate parity holds and the

Q22: A _ allows customers to send payments

Q28: To _, MNCs can use preauthorized payments.

A)

Q34: Matis Corporation invests 1,500,000 South African rand

Q35: Assume that interest rate parity holds. The

Q40: Lockboxes are post office box numbers assigned

Q42: If interest rate parity does not hold,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents