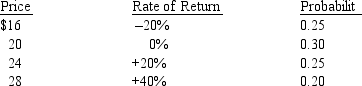

Phoenix Company common stock is currently selling for $20 per share.Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the standard deviation of possible rates of return on Phoenix stock (to the nearest tenth of a percent) .

A) 456%

B) 20.9%

C) 2.2%

D) 21.4%

Correct Answer:

Verified

Q47: The term structure of interest rates is

Q47: The default risk premium reflects the fact

Q48: The risk-free rate of return is composed

Q49: Phoenix Company common stock is currently selling

Q50: Phoenix Company common stock is currently selling

Q50: On the capital market line (CML), any

Q52: The following yields on 20 year bonds

Q53: According to the , long-term interest rates

Q54: The term structure of interest rates is

Q56: The ability of an investor to buy

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents