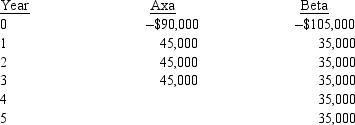

Toy Manufacturers (TM) is considering two mutually exclusive machines to use in its manufacturing process.The net cash flows for each are given below:

If the cost of capital for TM is 13%, which machine should they purchase?

A) Beta: has the highest total net cash flows

B) Beta: it has the highest NPV

C) Axa: it has the highest NPV using infinite replacement

D) Beta: it has the highest NPV using infinite replacement

Correct Answer:

Verified

Q2: Rollerblade, a maker of skating gear, is

Q4: What is the equal annual annuity

Q5: Quorex is evaluating two mutually exclusive projects.Project

Q6: Lakeland Ramblers is considering two mutually exclusive

Q6: The best way to measure projects with

Q7: Under most conditions the equivalent annual annuity

Q8: The advantage(s) of the equivalent annual annuity

Q9: Kaneb is evaluating two alternative pipeline welders.Welder

Q11: What does a firm ignore if it

Q11: Creative Furniture is considering two mutually exclusive

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents