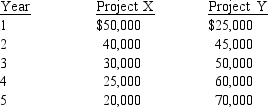

Quick Flick is considering two investments.Both require a net investment of $120,000 and have the following net cash flows:

Quick uses a combination of the net present value approach and the payback approach to evaluate investment alternatives.The firm uses a discount rate of 14 percent and requires that all projects have a payback period no longer than 3 years.Which investment or investments should Quick accept?

A) only Project X

B) only Project Y

C) both projects X and Y

D) reject both projects

Correct Answer:

Verified

Q55: American Biodyne (AB) is considering expanding into

Q55: IKON is financed entirely with equity, and

Q56: Determine the coefficient of variation for

Q56: Which of the following statements is correct

Q57: All of the following are correct statements

Q58: All of the following techniques are used

Q61: Haulin' It Towing Company is considering

Q62: are needed for sensitivity analysis and have

Q63: When is the risk-adjusted discount rate approach

Q64: List the ways that a company's decision

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents