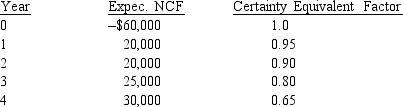

DKA uses the certainty equivalent approach to deal with total project risk and is considering a project with the following:

What is the certainty equivalent NPV for this project if the risk-free rate is 8% and the required return on the market portfolio is 15%?

A) $3,233

B) $17,743

C) -$15,243

D) $13,233

Correct Answer:

Verified

Q41: Given the following cash flows and

Q42: The Chris-Kraft Co.is financed entirely with equity

Q44: Billy Bob is considering building a water

Q45: Many firms combine net present value and

Q47: A weakness of the net present value/payback

Q48: M-tel is financed entirely with equity, and

Q49: Rolling in Dough Cookie Corporation is trying

Q51: The certainty equivalent approach is a risk

Q52: Portfolio risk is also known as _.

A)

Q59: MedChem has a capital structure of 60%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents