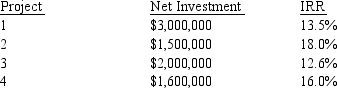

Far Out Tech (FOT) has a debt ratio of 0.3 and it considers this to be its optimal capital structure.FOT has no preferred stock.FOT has analyzed four capital projects for the coming year as follows:

FOT expects to earn $2.7 million after tax next year and pay out $700,000 in dividends.Dividends are expected to be $1.05 a share during the coming year and are expected to grow at a constant rate of 10 percent a year for the foreseeable future.The current market price of FOT stock is $22 and up to $2 million in new equity can be raised for a flotation cost of 10 percent.If more than $2 million is sold then the flotation cost will be 15 percent.Up to $2 million in debt can be sold at par with a coupon rate of 10 percent.Any debt over $2 million will carry a 12 percent coupon rate and be sold at par.If FOT has a marginal tax rate of 40 percent, in which projects should it invest?

A) 1, 2, 3, & 4

B) 2

C) 1, 2, and 4

D) 2 and 4

Correct Answer:

Verified

Q47: Pluega Inc. issued a $100 million 8.27%

Q53: What is the cost of a preferred

Q56: The following financial information is available on

Q58: A firm with a 40 percent marginal

Q59: What is the cost of equity for

Q64: Sadaplast has a target capital structure of

Q64: Whipple Industries, Inc.is in the process of

Q69: Investors can form earnings growth expectations from

Q72: Temple Company's common stock dividends have grown

Q79: Mahlo is planning to diversify into the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents