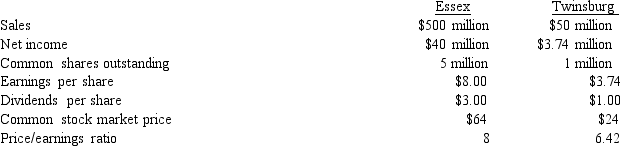

Essex Industries is considering the acquisition of the Twinsburg Company in a stock-for-stock exchange. The following financial data are available on both companies. (Assume no synergy is expected with this merger.) Calculate answers to nearest 0.001.

-Calculate the exchange ratio if Essex offers the Twinsburg stockholders a 20% premium over Twinsburg's current market price.

A) 0.375

B) 2.22

C) 0.45

D) 0.288

Correct Answer:

Verified

Q46: Buggy Whip Industries is being liquidated under

Q47: Price = $8.10 × 7.5 = $60.75

Q49: Osicom Tech is acquiring Rexon's outstanding common

Q50: What is Essex's post-merger share price if

Q51: A plan of reorganization must be all

Q52: Sunlite is considering a merger with Velo

Q53: Morgan Foods is considering the acquisition of

Q54: Endevco is considering the acquisition of Geothermal

Q56: Quarter Staff is being liquidated under Chapter

Q60: A firm is technically insolvent when it

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents