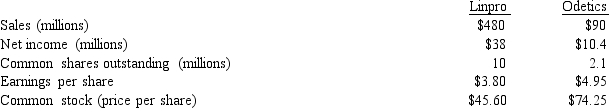

Linpro Industries is considering the acquisition of Odetics, Inc.in a stock-for-stock exchange.Assume no immediate synergistic benefits are expected.Selected financial data on the two companies are shown below:

Calculate Linpro's postmerger EPS if the Odetics shareholders accept an offer of $90 a share in a stock-for-stock exchange.

A) $4.38

B) $4.29

C) $3.42

D) $3.81

Correct Answer:

Verified

Q40: Technical insolvency occurs when

A)the firm is unable

Q41: The most correct method of valuing a

Q41: Whipple Industries is considering the acquisition of

Q43: The annual after-tax free cash flow from

Q46: The _ is the number of acquiring

Q46: Buggy Whip Industries is being liquidated under

Q47: Price = $8.10 × 7.5 = $60.75

Q49: Osicom Tech is acquiring Rexon's outstanding common

Q50: What is Essex's post-merger share price if

Q60: A firm is technically insolvent when it

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents