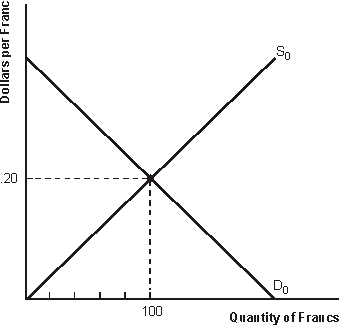

Figure 17.3 The Swiss Franc Under a System of Floating Exchange Rates

-Refer to Figure 17.3. If interest rates in the U.S. rise relative to interest rates in Switzerland, then we would expect a(n)

A) increase in the demand for francs, a decrease in the supply of francs, and a depreciation of the dollar

B) increase in the demand for francs, a decrease in the supply of francs, and an appreciation of the dollar

C) decrease in the demand for francs, an increase in the supply of francs, and an appreciation of the dollar

D) decrease in the demand for francs, a decrease in the supply of francs, and a depreciation of the dollar

Correct Answer:

Verified

Q48: Assume that the U.S. faces an 8

Q49: A primary explanation for an appreciation in

Q50: In a floating exchange rate system, a

Q51: If the Mexican peso is appreciating in

Q52: Figure 17.3 The Swiss Franc Under a

Q54: Figure 17.3 The Swiss Franc Under a

Q55: Figure 17.3 The Swiss Franc Under a

Q56: Figure 17.3 The Swiss Franc Under a

Q57: Figure 17.3 The Swiss Franc Under a

Q58: Advocates of floating exchange rates contend that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents