First Bank recognized an extraordinary loss from the settlement of a lawsuit with Fifth Street Bank that it had impeded on a processing patent.The extraordinary loss was in the amount of $4,250,000 and First Bank Corporation has an effective tax rate of 35%.First Bank paid the settlement immediately and recognized the tax benefit as a receivable to offset the current period's taxes.

Instructions:a.Prepare the extraordinary item portion of First Bank Corporation's financial statement.

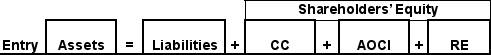

b.Using the analytical framework discussed in the text and reprinted below show the effect of following event on First Bank Corporation's financial statements.

Analytical Framework:

Correct Answer:

Verified

b.

an...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: Banks Corp.reported net income of $595,000 in

Q46: Earnings are informative if they signal the

Q51: An extraordinary gain or loss is unusual

Q55: On September 1,2012,Ramos Inc.approved a plan

Q58: _ represents the concept of being able

Q59: U.S.GAAP requires that changes in estimates be

Q62: Achieving comparability in financial reporting is important

Q63: A company may try to paint a

Q66: Many times an analyst will have to

Q71: On November 15,2012,Jacobs Co.sold a segment of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents