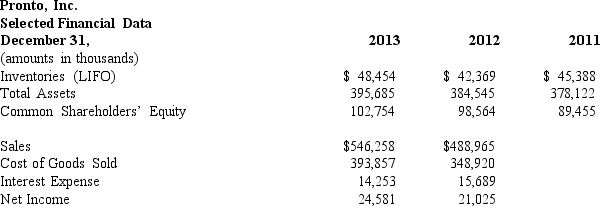

Pronto,Inc.is a major producer of printing equipment.Pronto uses a LIFO cost-flow assumption for inventories.The company's tax rate is 35%.Below is selected financial data for the company.

Required:a.The excess of FIFO over LIFO inventories was $25 million on December 31,2013,$28.5 million on December 31,2012 and $22 million on December 31,2011.Compute the cost of goods sold for Pronto,Inc.for years 2013 and 2012 assuming that it had used a FIFO assumption.

b.Compute the inventory turnover ratio for Pronto,Inc.for years 2013 and 2012 using a LIFO cost-flow assumption.

c.Compute the inventory turnover ratio for Pronto,Inc.for years 2013 and 2012 using a FIFO cost-flow assumption.

d.Compute the rate of return on assets for years 2013 and 2012 based on the reported amounts.Disaggregate ROA into profit margin and asset turnover components.

e.Compute the rate of return on assets for years 2013 and 2012 assuming that Pronto,Inc.had used the FIFO method of accounting for inventories.Disaggregate ROA into profit margin and asset turnover components.

Correct Answer:

Verified

a.The excess of FIFO over LIFO...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: _ is primarily a question of timing.

Q47: A contractor would not use _ method

Q48: Derivative instruments acquired to hedge exposure may

Q49: A company that uses FIFO will find

Q50: A company that uses LIFO will find

Q52: Companies that engage in long-term contracts can

Q71: When cash collectibility is uncertain,a firm using

Q73: A company that uses LIFO will experience

Q80: When cash collectibility is uncertain the _

Q81: Given the following information,compute December 31,2012

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents