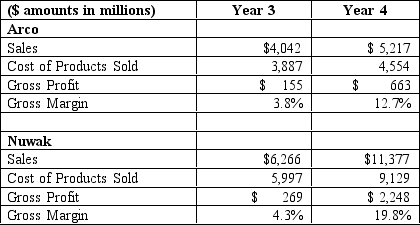

Arco is an integrated manufacturer in capital-intensive industry.Nuwak manufactures more commodity-level products in the same industry at the lower end of the market and uses less capital-intensive processes.The following data describe sales and cost of products sold for both firms for Years 3 and 4.

Industry analysts anticipate the following annual changes in sales for the next five years:

Year +1,5 percent increase;Year +2,10 percent increase;Year +3,20 percent increase;Year +4,10 percent decrease;Year +5,20 percent decrease.

Required: a.The analyst can sometimes estimate the variable cost as a percentage of sales for a

particular cost (for example,cost of products sold)by dividing the amount of the

change in the cost item between two years by the amount of the change in sales for

those two years.The analyst can then multiply the variable-cost percentage times

sales to estimate the total variable cost.Subtracting the variable cost from the total

cost yields an estimate of the fixed cost for that particular cost item.Follow this procedure

to estimate the manufacturing cost structure (variable cost as a percentage of

sales,total variable costs,and total fixed costs)for cost of products sold for both Arco and Nuwak in Year 4.

b.Discuss the structure of manufacturing cost (that is,fixed versus variable)for each

firm in light of the manufacturing process and type of product produced.

c.Using the analysts' forecasts of sales changes,compute the projected sales,cost of

products sold,gross profit,and gross margin (gross profit as a percentage of sales)

of each firm for Year +1 through Year +5.

d.Why do the levels and variability of the gross margin percentages differ for these two

firms for Year +1 through Year +5?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: When projecting _,the analyst should consider economy-wide

Q42: If a firm operates at less then

Q44: Based on the following statement from the

Q45: The following information about Douglas Corp.'s

Q45: For some types of assets,such as accounts

Q46: Office Mart,Inc.sells numerous office supply products through

Q49: The first step in the forecasting game

Q50: The following balance sheet and income

Q52: Analysts must develop realistic expectations for the

Q52: Glad Rags,Inc.sells women's clothes.Provided below is selected

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents