Carr Industries must raise $100 million on January 1,2012 to finance its expansion into a new market.The company will use the money to finance construction of four retail outlets and a distribution center.The stores are expected to open later this year.The CFO has come up with three alternatives for raising the money:

1)Issue $100 million of 8% nonconvertible debt due in 20 years.

2)Issue $100 million of 6% nonconvertible preferred stock (100,00 shares).

3)Issue $100 million of common stock (1 million shares).

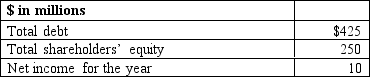

The company's internal forecasts indicate the following 2012 year-end amounts before any option is chosen:

Carr has no preferred stock outstanding but currently has 10 million shares of common stock outstanding.EPS has been declining for the past several years.Earnings in 2011 were $1 per share,which was down from $1.10 during 2010,and management wants to avoid another decline during 2012.One of the company's existing loan agreements requires a debt-to-equity ratio to be less than2.Carr pays taxes at a 40% rate.

Required:1.Assess the impact of each financing alternative on 2012 EPS and the year-end debt to equity ratio.

2.Which financing alternative would you recommend and why?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: For each of the following scenarios determine

Q43: Watson manufactures and sells appliances.Intro develops and

Q44: The dividends valuation approach measures value-relevant dividends

Q44: Shady Sunglasses operates retail sunglass kiosks in

Q45: For each of the following companies,determine the

Q49: The following financial statement data pertains

Q49: Why is the dividends valuation approach applicable

Q50: According to the text,dividends are value-relevant even

Q50: The following financial statement data pertains to

Q51: The following data pertain to Loren Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents