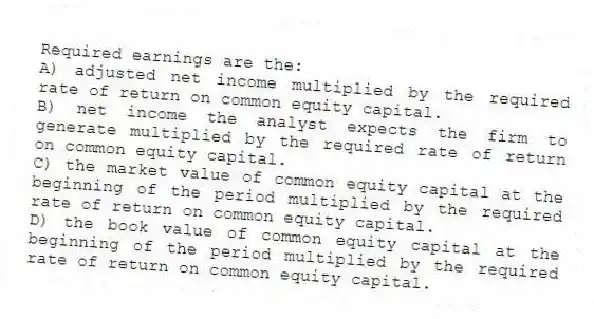

Required earnings are the:

A) adjusted net income multiplied by the required rate of return on common equity capital.

B) net income the analyst expects the firm to generate multiplied by the required rate of return on common equity capital.

C) the market value of common equity capital at the beginning of the period multiplied by the required rate of return on common equity capital.

D) the book value of common equity capital at the beginning of the period multiplied by the required rate of return on common equity capital.

Correct Answer:

Verified

Q15: Jarrett Corp.

At the end of 2010

Q16: The appropriate discount rate for the residual

Q17: Jarrett Corp.

At the end of 2010

Q18: Over the life of a firm,the capital

Q19: Residual income is the:

A) difference between the

Q21: Which of the following is probably the

Q22: The residual income _ valuation model uses

Q23: Dirty surplus items in U.S.GAAP typically arise

Q24: Early in a period in which sales

Q25: In theory,all three valuation models,when correctly implemented

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents