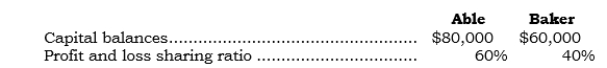

_____ Data for the partnership of Able and Baker follow: Cook is to be admitted into the partnership and is to have a one-fifth interest in capital and profits with a cash contribution of $40,000. The balances in the capital accounts of Able, Baker, and Cook under the recording the goodwill method are:

Cook is to be admitted into the partnership and is to have a one-fifth interest in capital and profits with a cash contribution of $40,000. The balances in the capital accounts of Able, Baker, and Cook under the recording the goodwill method are:

A) $80,000, $60,000, and $40,000, respectively.

B) $92,000, $68,000, and $40,000, respectively.

C) $95,000, $65,000, and $40,000, respectively.

D) $82,400, $61,600, and $36,000, respectively.

E) None of the above.

Correct Answer:

Verified

Q18: _ When a person is being admitted

Q19: _ When a person is being admitted

Q20: _ When a person is being admitted

Q21: _ When Dubke retired from the partnership

Q22: _ Data for the partnership of A

Q24: _ Data for the partnership of X

Q25: _ Data for the partnership of X

Q26: _ Ames and Buell are partners who

Q27: _ At 12/31/06, Reed and Quinn are

Q28: _ Diller decided to withdraw from the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents