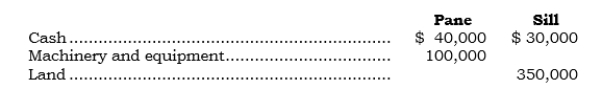

_____ On 7/1/06, Pane and Sills formed a partnership, and each contributed assets with agreed-upon values as follows: The building is subject to a mortgage loan of $100,000, which is to be assumed by the partnership. The agreed-upon value of the building is $50,000 more than its tax basis of $300,000. The partnership agreement provides that Pane and Sills share profits and losses 60% and 40%, respectively.

The building is subject to a mortgage loan of $100,000, which is to be assumed by the partnership. The agreed-upon value of the building is $50,000 more than its tax basis of $300,000. The partnership agreement provides that Pane and Sills share profits and losses 60% and 40%, respectively.

What is the tax basis of Sills on 7/1/06?

A) $330,000

B) $380,000

C) $300,000

D) $280,000

E) $270,000

Correct Answer:

Verified

Q35: From a tax perspective, a partner's interest

Q36: Income tax laws concerning partnerships are centered

Q37: For income tax-reporting purposes, a partner's _

Q38: Income tax laws pertaining to partnerships are

Q39: For tax purposes, a partner's interest in

Q40: For tax purposes, a partner's tax basis

Q41: When a partnership borrows money from a

Q42: _ For tax-reporting purposes,

A) A partner's tax

Q44: _ In January 2006, Conn and Krete

Q45: _ When a partnership borrows money from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents