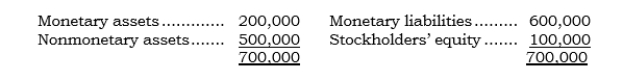

_____ Parco's German subsidiary is Sarco. On 12/31/05, Parco concluded that the euro would weaken during the remainder of 2006. On this date, Sarco's balance sheet in euros was as follows: Sarco's functional currency is the U.S. dollar. On 12/31/05, Parco entered into a 12-month FX forward to sell 100,000 euros at the forward rate of $.60 (the spot rate at the time was also $.60) . On 12/31/06, Parco settled the FX forward when the direct exchange rate was $.56. Using only the above information, what is the net amount Parco reports in its FX Gain or Loss account (that includes the remeasurement gain or loss) for 2006?

Sarco's functional currency is the U.S. dollar. On 12/31/05, Parco entered into a 12-month FX forward to sell 100,000 euros at the forward rate of $.60 (the spot rate at the time was also $.60) . On 12/31/06, Parco settled the FX forward when the direct exchange rate was $.56. Using only the above information, what is the net amount Parco reports in its FX Gain or Loss account (that includes the remeasurement gain or loss) for 2006?

A) No net gain or loss ($4,000 gain from the hedging transaction offset by a $4,000 loss from the remeasurement process) .

B) A $4,000 loss from the hedging transaction.

C) A $4,000 gain from the hedging transaction.

D) A $12,000 gain ($4,000 loss from the hedging transaction netted against a $16,000 gain from the remeasurement process) .

E) A $20,000 gain ($4,000 gain from the hedging transaction plus a $16,000 gain from the remeasurement process) .

Correct Answer:

Verified

Q121: _ Following are certain items (accounts or

Q122: _ Following are certain items (accounts or

Q123: _ On 12/31/06, Polbex's payable to a

Q124: _ On 12/31/06, Polex's payable to a

Q125: _ On 11/11/06, Puzco sold inventory costing

Q127: _ Paxco has a British subsidiary, Saxco.

Q128: Indicate which of the following exchange rates

Q129: A domestic company's 100%-owned foreign subsidiary located

Q130: A domestic company's 100%-owned foreign subsidiary located

Q131: Various data for Jackson Corporation's overseas subsidiaries

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents