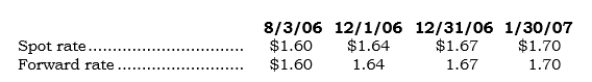

_____ On 8/3/06, Buyox entered into a noncancellable purchase agreement with a British vendor involving a custom-made machine. Buyox took delivery of the machine on 12/1/06 (120 days later) . The purchase price was 100,000 pounds, which Buyox remitted to the vendor on l/30/07 (60 days after delivery) . Direct exchange rates on the respective dates are as follows: Also on 8/3/06, Buyox entered into a 180-day FX forward to buy 100,000 pounds. What is the FX gain or loss recognized in earnings for 2006 on the FX commitment?

Also on 8/3/06, Buyox entered into a 180-day FX forward to buy 100,000 pounds. What is the FX gain or loss recognized in earnings for 2006 on the FX commitment?

A) $ -0-

B) $4,000 gain.

C) $4,000 loss.

D) $7,000 gain.

E) $7,000 loss.

Correct Answer:

Verified

Q238: _ On 11/10/06, Specutex entered into a

Q239: _ On 11/10/06, Buymax entered into a

Q240: _ On 11/10/06, Selmax entered into a

Q241: _ On 10/22/06, Sellex entered into a

Q242: _ On 8/3/06, Buyox entered into a

Q244: _ On 10/10/06, Selcor entered into a

Q245: _ On 10/10/06, Selcor entered into a

Q246: _ On 1/1/06, Putax purchased a 1-year

Q247: _ Use the information in the preceding

Q248: _ On 1/1/06, Callex purchased a 1-year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents