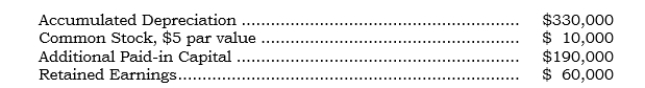

On 6/3/06, Ponex acquired 100% of Sonex's outstanding common stock. At the acquisition date, Sonex had the following account balances:

The only assets or liabilities under- or overvalued at the acquisition date were as follows:

The only assets or liabilities under- or overvalued at the acquisition date were as follows:

Land-undervalued by $155,000

Patent-overvalued by $40,000

Goodwill paid for in the acquisition was calculated at $75,000.

Required:

Prepare all entries required to achieve the push-down basis of accounting.

Correct Answer:

Verified

Q42: _ Immediately before applying push-down accounting, the

Q43: _ In a leveraged buyout, which of

Q44: _ In a leveraged buyout, which of

Q45: _ In a leveraged buyout, a new

Q46: _ In a leveraged buyout, carryover of

Q47: _ In a leveraged buyout, carryover of

Q48: _ In a leveraged buyout, carryover of

Q50: On 8/5/06 Pellax acquired 100% of Sellax's

Q51: On 5/5/06, a leveraged buyout occurred for

Q52: On 12/12/06, a leveraged buyout occurred for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents