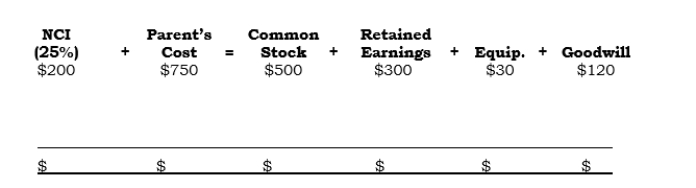

_____ On 1/1/06, Platt acquired 75% of Slatt's outstanding common stock. The analysis of the Investment account (in thousands) as of that date under the parent company concept follows: Additional information:

Additional information:

A.Slatt had net income of $300,000 in 2006.

B.Slatt declared dividends of $100,000 in 2006.

C.Slatt paid dividends of $60,000 on 12/23/06. (The remaining $40,000 of dividends declared in 2006 was paid on 1/10/07.)

D.Platt uses the equity method of accounting.

E.The undervalued equipment has a 10-yr. remaining life.

What is the carrying value of the investment at 12/31/06?

A) $896,000

B) $897,000

C) $926,000

D) $927,000

E) None of the above.

Correct Answer:

Verified

Q48: _ On 7/1/06, Pane acquired 60% of

Q49: _ On 4/1/06, Pax acquired 80% of

Q50: _ On 9/30/06, Pittco acquired 75% of

Q51: _ On 5/1/06, Pixco issued shares of

Q52: _ On 5/1/06, Pixco issued shares of

Q54: _ On 1/1/06, Platt acquired 75% of

Q55: _ On 1/1/06, Platt acquired 75% of

Q56: _ On 7/1/06, Pablex acquired 75% of

Q57: _ On 7/1/06, Pablex acquired 75% of

Q58: _ Use the information in the second

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents