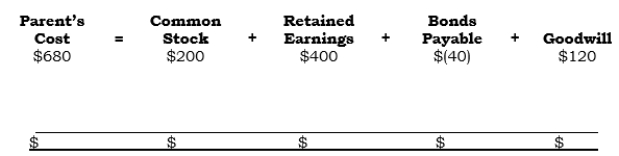

On 1/1/06, Penn acquired 100% of Senn's outstanding common stock. The analysis of the Investment account (in thousands) as of that date follows:

Additional Information:

Additional Information:

a. The subsidiary had net income of $70,000 in 2006.

b. The subsidiary declared dividends of $30,000 in 2006.

c. The subsidiary paid dividends of $20,000 on 10/19/06. (The remaining $10,000 of dividends declared in 2006 was paid on 1/20/07.)

d. The bonds have a remaining life of 5 years.

e. The subsidiary's accumulated depreciation at the acquisition date was $55,000.

Required:

Prepare all consolidation entries as of 12/31/06.

Correct Answer:

Verified

Q58: _ Use the information in the second

Q59: _ On 1/1/06, Pongo acquired 66 2/3%

Q60: On 5/1/06, Podex acquired 100% of Sodex's

Q61: On 10/1/06, Plyco issued shares of its

Q62: On 1/1/06, Podcom acquired 100% of Sodcom's

Q64: COMPREHENSIVE

On 7/1/06, PBM Company acquired 100% of

Q65: On 9/1/06, Panco acquired 80% of Sanco's

Q66: On 4/1/06, Parrco acquired 60% of Subbco's

Q67: Pyna acquired 75% of Syna's outstanding common

Q68: Pimex acquired 80% of Simex's outstanding common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents