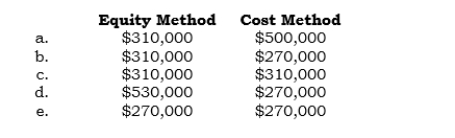

_____ On 5/1/05, Pax Inc. created Sax Inc., investing $500,000 cash. Sax reported a highly unexpected $230,000 loss for 2005 and a $40,000 profit for 2006. The 2005 loss created substantial doubt as to (a) the ability of the subsidiary to survive and (b) the ability of the parent to sell the subsidiary at other than an amount substantially below its initial investment. What should the carrying value of Pax's investment in Sax be at 12/31/06 under each of the following methods?

Correct Answer:

Verified

Q65: _ On 1/1/06, Parco created a 100%-owned

Q66: _ On 5/1/06, Pyne Inc. formed Syne

Q67: _ On 5/1/06, Pyne Inc. formed Syne

Q68: _ On 4/1/06, Pix Inc. formed Stix

Q69: _ On 4/1/06, Pix Inc. formed Stix

Q71: _ On 1/1/06, the carrying value of

Q72: _ On 5/1/05, Platt created a 100%-owned

Q73: _ The following accounts are as they

Q74: _ The following accounts are as they

Q75: _ The following accounts are as they

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents