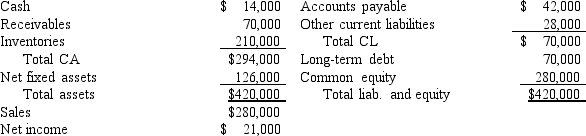

Muscarella Inc.has the following balance sheet and income statement data:

The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average,2.70,without affecting either sales or net income.Assuming that inventories are sold off and not replaced to get the current ratio to the target level,and that the funds generated are used to buy back common stock at book value,by how much would the ROE change?

A) 4.28%

B) 4.50%

C) 4.73%

D) 4.96%

E) 5.21%

Correct Answer:

Verified

Q76: For the coming year,Crane Inc.is considering two

Q80: Harper Corp.'s sales last year were $395,000,and

Q81: Exhibit 3.1

The balance sheet and income statement

Q82: Exhibit 3.1

The balance sheet and income statement

Q84: Stewart Inc.'s latest EPS was $3.50, its

Q84: Exhibit 3.1

The balance sheet and income statement

Q85: Last year Vaughn Corp.had sales of $315,000

Q85: Exhibit 3.1

The balance sheet and income statement

Q86: Exhibit 3.1

The balance sheet and income statement

Q87: Exhibit 3.1

The balance sheet and income statement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents