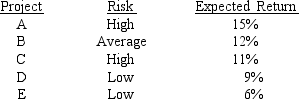

Laramie Labs uses a risk-adjustment when evaluating projects of different risk.Its overall (composite) WACC is 10%,which reflects the cost of capital for its average asset.Its assets vary widely in risk,and Laramie evaluates low-risk projects with a WACC of 8%,average-risk projects at 10%,and high-risk projects at 12%.The company is considering the following projects:

Which set of projects would maximize shareholder wealth?

A) A and B.

B) A, B, and C.

C) A, B, and D.

D) A, B, C, and D.

E) A, B, C, D, and E.

Correct Answer:

Verified

Q21: Which of the following rules is CORRECT

Q22: When evaluating a new project, firms should

Q29: Collins Inc.is investigating whether to develop a

Q30: Which of the following should be considered

Q46: You have just landed an internship

Q47: To increase productive capacity,a company is considering

Q51: Tallant Technologies is considering two potential projects,X

Q53: While developing a new product line,Cook Company

Q62: Which of the following statements is CORRECT?

A)

Q78: Wansley Enterprises is considering a new project.The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents