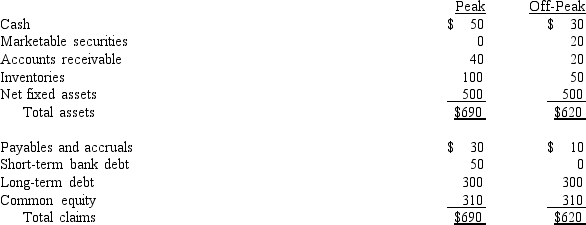

Summary balance sheet data for Greener Gardens Co.is shown below (in thousands of dollars) .The company is in a highly seasonal business,and the data show its assets and liabilities at peak and off-peak seasons:

From this data we may conclude that

A) Greener Gardens' current asset financing policy is relatively aggressive; that is, the company finances some of its permanent assets with short-term discretionary debt.

B) Greener Gardens follows a relatively conservative approach to current asset financing; that is, some of its short-term needs are met by permanent capital.

C) Without income statement data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy.

D) Without cash flow data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy.

E) Greener Gardens' current asset financing policy calls for exactly matching asset and liability maturities.

Correct Answer:

Verified

Q4: Which of the following will cause an

Q36: Which of the following actions should Reece

Q45: For a zero-growth firm, it is possible

Q46: A firm's collection policy, i.e., the procedures

Q71: If a firm sells on terms of

Q89: If a profitable firm finds that it

Q93: If one of your firm's customers is

Q103: The risk to the firm of borrowing

Q111: A lockbox plan is most beneficial to

Q127: A firm constructing a new manufacturing plant

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents