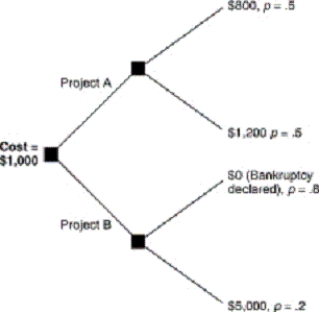

Consider this decision tree,which represents the outcomes of two alternative projects that Ink Inc.,a producer of printers,might pursue.Ink Inc.,needs to borrow $1,000 to pursue either project and is going to sell bonds to finance the venture.

Ink,Inc.,is carrying a large amount of debt because of overexpansion during the dot-com explosion.Under these circumstances,the shareholders would tend to choose:

A) project A, because it has the highest expected value.

B) project B, because it has the greatest degree of risk.

C) project A, because it has the lowest degree of risk.

D) neither project A nor B, because both are risky.

E) either project A or B; both have the same degree of risk.

Correct Answer:

Verified

Q14: Incentive-compatible employment contracts exist when:

A) the firm

Q15: The savings and loan crisis of the

Q16: Use the following profit function (per worker)for

Q17: Donald has a beach house on the

Q18: Principal-agent problems can exist between:

A) workers and

Q19: Optimal employment contracts for managers,given revenue risk

Q20: Consider Mr.Ed,who purchases an insurance policy on

Q21: Firms can avoid or limit the asset

Q23: Consider this decision tree,which represents the outcomes

Q24: In recent years,individuals and state governments have

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents