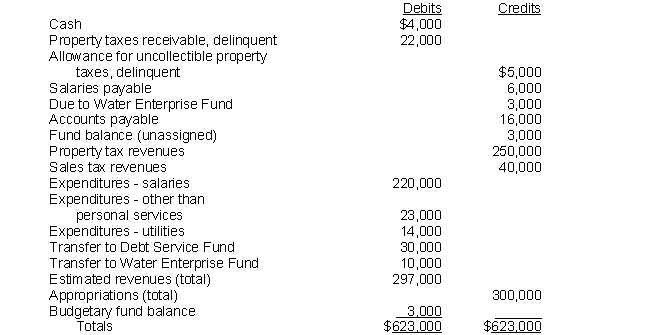

Following is a pre-closing trial balance of a village's General Fund at December 31, 2019. The amount shown as Fund balance (unassigned) has not changed since the year started. The amount shown as appropriations includes the amounts appropriated for transfers. Property tax invoices are mailed out on January 10 and are due to be paid on February 10. Property owners that have not paid their taxes are classified as delinquent on March 10.  Required:

Required:

Based on the information contained in the foregoing trial balance, answer the following questions.

a. When the budget was adopted, what budgetary results did the village anticipate? (Assume the budgetary amounts shown in the trial balance represent the budget as originally adopted by the village.)

b. What were the results of operations for the year? Did the fund balance increase or decrease as a result of the year's activities, and by how much? How much will the amount of the unassigned fund balance be after the books are closed?

c. Based on your analysis of the data, what appears to be the major cause (or causes) of the difference between the anticipated and the actual operating results?

d. Discuss possible reasons for the transfers to the Debt Service Fund and the Water Enterprise Fund.

e. Discuss several possible reasons for the amount shown as Due to Water Enterprise Fund.

f. Assess the financial condition of the village based on the information given in the problem. Include a discussion of the village's quick ratio, number of days' cash on hand, and budgetary cushion in developing your conclusion.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: What is the purpose of analyzing a

Q43: Which of the following factors and data

Q44: Financial condition analysis is conducted for many

Q45: Calculate and then make an assessment based

Q46: Calculate the Plains Regional Hospital's days' revenue

Q47: The following data affecting the calculation of

Q48: The following data is extracted from

Q49: The following information is taken from QuickFacts

Q50: Following is a trial balance (with 000

Q52: The following data comes from the 2020

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents