Glencore Co is a glasses manufacturing company. Glencore is considering purchasing a new piece of manufacturing equipment for $2,000,000. The equipment is expected to last for 10 years, and management projects that purchasing the equipment would result in an additional $300,000 in pre-tax cash flow per year. Management does not expect the equipment to have any value at the end of 10 years, and so will fully depreciate the equipment on a straight-line basis.

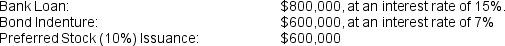

To obtain the funds to purchase this equipment, Glencore plans to raise capital from the following sources:

Glencore's tax rate is 20%.

Glencore's tax rate is 20%.

What is the Net Present Value of the proposed investment? Use a financial calculator to compute the Present Value of the future cash flows.

Correct Answer:

Verified

Bank L...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q153: What are some of the drawbacks of

Q154: Why does the present value of positive

Q155: Using a financial calculator, how would someone

Q156: In what number format should the interest

Q157: What financial spreadsheet function could be used

Q159: J & S Bridal Inc., a local

Q160: Arbitrary Inc. has is planning to purchase

Q161: Local Grown Inc., a local plant nursery,

Q162: Home Growers, a local plant nursery, is

Q163: GoodWash Co. is a dishwasher manufacturing company.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents