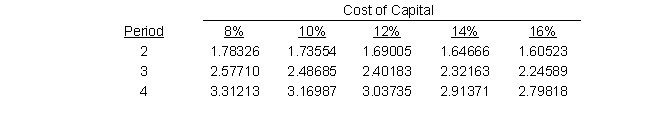

Westmont Publishing is considering the purchase of a used printing press costing $75,200. The printing press would generate a net cash inflow of $31,310 a year for 3 years. At the end of 3 years, the press would have no salvage value. The company's cost of capital is 10 percent. The company uses straight-line depreciation. The present value factors of an annuity of $1.00 for different rates of return are as follows: The investments internal rate of return (rounded to the nearest percent) is:

The investments internal rate of return (rounded to the nearest percent) is:

A) 10 percent

B) 16 percent

C) 14 percent

D) 12 percent

Correct Answer:

Verified

Q22: The internal rate of return:

A) Does not

Q23: A project's _is computed as the present

Q24: Which of the following is needed to

Q25: Pipette Medical Services is considering an

Q26: Pipette Medical Services is considering an

Q28: Westmont Publishing is considering the purchase of

Q29: Westmont Publishing is considering the purchase of

Q30: Westmont Publishing is considering the purchase of

Q31: The internal rate of return is sometimes

Q32: The_is the discount rate that equates the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents