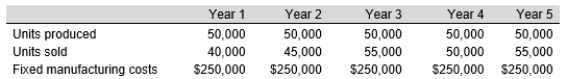

The Grand Rapid Corporation has two identical divisions: Western and Northern. Their sales, production volume, and fixed manufacturing costs have been the same for both divisions for the last five years and are as follows:

Western uses absorption costing and Northern uses variable costing. Both use FIFO inventory methods. Variable manufacturing costs are $5 per unit. Both have identical selling prices and selling and administrative expenses. There were no Year 1 beginning inventories.

Western uses absorption costing and Northern uses variable costing. Both use FIFO inventory methods. Variable manufacturing costs are $5 per unit. Both have identical selling prices and selling and administrative expenses. There were no Year 1 beginning inventories.

Determine the difference in profits for each division for Years 1 through 5. Explain why profits differ between the two divisions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: Information from The Crossroad Company is given

Q93: Coleman Manufacturing Company began July with 25,000

Q94: Northern Company manufactures a product that passes

Q95: Aston Corporation produces a product that passes

Q96: Casey Company manufactures a product that passes

Q98: Willow Company produced 15,000 units and sold

Q99: Arthur Corporation wants to change to the

Q100: The variable costing income statement for Holt

Q101: Andrea Cookie Company produced 5,000 cases of

Q102: Compare the challenge of determining unit production

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents