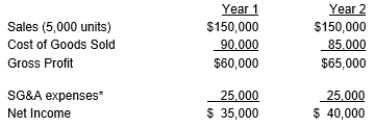

Arthur Corporation wants to change to the variable costing method of inventory valuation for making internal decisions. The LIFO method is being used. The absorption statements of income for Years 1 and 2 are as follows:

*Selling and administrative expenses include variable costs of $2 per unit sold.

*Selling and administrative expenses include variable costs of $2 per unit sold.

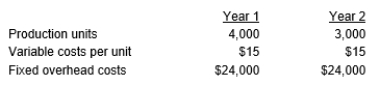

Production data are as follows:

Required:

Required:

a. Compute the absorption cost per unit manufactured in Years 1 and 2.

b. Explain why the net income for Year 1 was higher than the net income for Year 2 when the same number of units was sold in each year.

c. Prepare income statements for both years using variable costing.

d. Reconcile the absorption costing and variable costing net income figures for each year. Start with variable costing net income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q94: Northern Company manufactures a product that passes

Q95: Aston Corporation produces a product that passes

Q96: Casey Company manufactures a product that passes

Q97: The Grand Rapid Corporation has two identical

Q98: Willow Company produced 15,000 units and sold

Q100: The variable costing income statement for Holt

Q101: Andrea Cookie Company produced 5,000 cases of

Q102: Compare the challenge of determining unit production

Q103: Briefly discuss and give examples of the

Q104: Describe the difference between job-order and process

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents