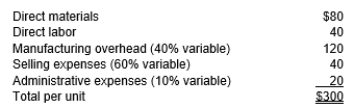

Lorraine manufactures a single product with the following full unit costs for 3,000 units:

A company recently approached Lorraine with a special order to purchase 500 units for $300. Lorraine currently sells the models to dealers for $550. Capacity is sufficient to produce the extra 1,000 units. No selling expenses would be incurred on the special order.

A company recently approached Lorraine with a special order to purchase 500 units for $300. Lorraine currently sells the models to dealers for $550. Capacity is sufficient to produce the extra 1,000 units. No selling expenses would be incurred on the special order.

Required:

a. Ignoring the special order, determine Lorraine's profit on production and sales of 3,000 units. Ignore taxes in these analyses.

b. Should Lorraine accept the special order if its goal is to maximize short-run profits? Determine the impact on profit of accepting the order.

c. Determine the minimum price Lorraine would want, to increase before tax profits by $80,000 on the special order.

d. When making a special order decision, what non-quantitative aspects of the decision should Lorraine consider?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: The Copper Company manufactures 5,000 rolls of

Q49: The Yellow Corporation's management is evaluating a

Q50: The Herman Company uses a joint process

Q51: A limitation of 1,500 machine-hours per week

Q52: The Manhattan Manufacturing Company produces four different

Q54: Alpine produces a single product. The company's

Q55: XM Company currently buys 15,000 units of

Q56: The Freemont Company uses 2,500 units of

Q57: Volleyball Products manufactures a single product with

Q58: The Santa Fe Company uses a joint

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents