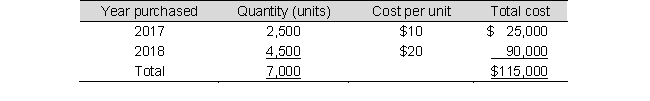

Crown Company imports and sells a product produced in Germany. In the summer of 2018, a natural disaster disrupted production, affecting its supply of product. Crown uses the LIFO inventory method. On January 1, 2019, Crown's inventory records were as follows:

Through mid-December of 2019, purchases were limited to 50,000 units, because the cost had increased to $25 per unit. Crown sold 55,000 units during 2019 at a selling price of $50 per unit, which significantly depleted its inventory. The cost was expected to drop to $21 per unit by early January, 2020.

Required:

a. Assume that Crown makes no further purchases during 2019. Compute the gross profit for 2019.

b. Assume that Crown purchases 8,800 units before the end of December, 2019 at $25 each. Compute its gross profit for 2019.

c. If Crown's corporate tax rate is 30%, how much tax savings will result from the purchase of inventory before year end?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: Benson Company uses the LIFO inventory costing

Q100: Nature Inc.'s inventories are determined using FIFO.

Q101: A company reports the following in its

Q102: Tisdell Fabricators, Inc., has 10 units in

Q103: At the beginning of July, Pulman Luggage

Q105: Sawyer Company reported the following net income

Q106: Lee Company reported the following net income

Q107: Best Buy Clothing had the following inventory

Q108: As a shareholder of Benson Industries, a

Q109: Selected balance sheet and income statement information

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents