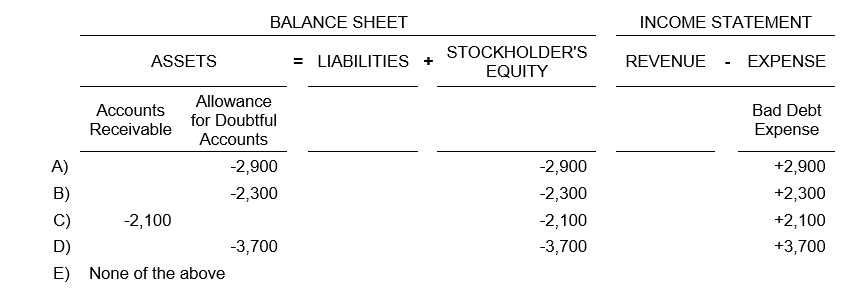

A firm's $90,000 Accounts Receivable balance at December 31 consisted of $80,000 current balances and $10,000 past-due balances. At December 31, the Allowance for Uncollectible Accounts had a balance of $800. The firm estimated that 2% of current balances and 15% of past-due balances will prove uncollectible. The effect of the adjustment to record credit losses on the financial statements is:

Correct Answer:

Verified

Q20: Net accounts receivable before write-offs is $845,000.

Q21: Benson Company estimates its uncollectible accounts by

Q22: On December 31, before adjusting entries, Accounts

Q23: The entry to record the write-off of

Q24: Assume the following unadjusted account balances at

Q26: Ruiz Company's Accounts Receivable balance at December

Q27: McKensie Company's Accounts Receivable balance at December

Q28: Mangini Company has net credit sales of

Q29: Assume the following unadjusted account balances at

Q30: Assume the following unadjusted account balances at

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents