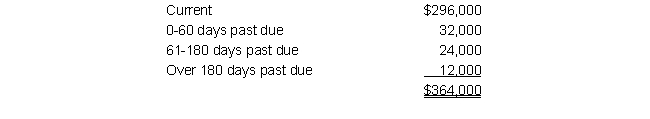

At December 31 of the current year, Roberts Company had a balance of $364,000 in its Accounts Receivable account and a balance of $3,000 in the Allowance for Doubtful Accounts. The company has aged its accounts as follows:

In the past, the company has experienced losses as follows: 1% of current balances, 5% of balances 0-60 days past due, 15% of balances 61-180 days past due, and 30% of balances over 180 days past due. The company bases its bad debt expense on the aging analysis.

In the past, the company has experienced losses as follows: 1% of current balances, 5% of balances 0-60 days past due, 15% of balances 61-180 days past due, and 30% of balances over 180 days past due. The company bases its bad debt expense on the aging analysis.

Required:

a. Determine the amount of bad debt expense for the year.

b. Show how Accounts Receivable and the Allowance for Doubtful Accounts would appear in the December 31 balance sheet.

c. On January 15 of the subsequent year, Roberts Company wrote off the account of B. Jensen, $1,200. What if the effect on gross receivables and total assets of the write off?

d. On February 20 of the subsequent year, Roberts Company collected the $1,200 on the Jensen account written off on January 15. What is the effect on the Allowance for Doubtful Accounts and Total Assets as a result of the recovery?

Correct Answer:

Verified

b.

c. Gross accounts receivable...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q70: Jackson, Inc. had net sales of $900,000

Q71: Quick Market reports the following analysis of

Q72: Oliver, Inc. estimated uncollectible accounts receivable at

Q73: Forrester Inc. provided the following aging of

Q74: Likert Co. reports the following in its

Q75: At December 31, 2019, Hanna Toys had

Q76: Rexbilt Company estimates its credit losses at

Q77: On January 1 of the current year,

Q79: Smith's accounts receivable financial data (in millions)

Q80: Define accounts receivable turnover and the average

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents