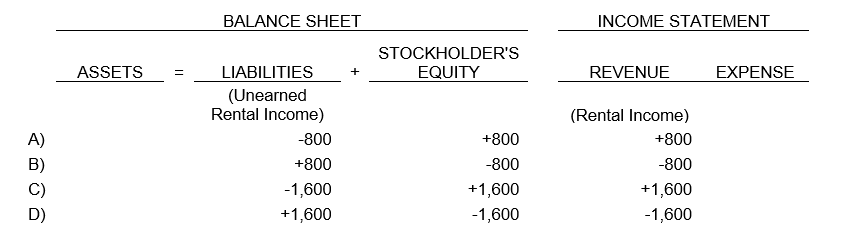

P. Disco received $2,400 from a tenant on December 1 for three months' rent of an office. This rent was for December, January, and February. If Disco increased Cash and increased Unearned Rental Income for $2,400 on December 1, what necessary adjustment would be made on December 31?

Correct Answer:

Verified

Q24: As supplies and PPE assets on the

Q25: An adjusting entry will not take the

Q26: Which one of the following errors causes

Q27: Which one of the following errors causes

Q28: M. Mabrey received $2,500 from a tenant

Q30: Early in the accounting period, a customer

Q31: On September 1, Best Company began a

Q32: On December 31, the end of the

Q33: Smith Company paid $26,400 for a four-year

Q34: Williams Company paid $24,000 for a two-year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents