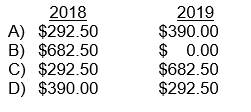

A bank customer received a loan for $13,000 in exchange for a 7-month, 9% note on October 1, 2018. The note is due on April 30, 2019. If the bank's accounting period ends on December 31 each year, how much interest revenue from this note should the bank recognize in the years 2018 and 2019?

Correct Answer:

Verified

Q97: Dakota Company received a $25,000, one year,

Q98: Williams Company has a policy of paying

Q99: Miller Company reported the following balances in

Q100: What accounts are affected by an adjusting

Q101: Mary Benoit has performed $1,500 of CPA

Q103: Phoenix Fitness Centers have 15,000 members whose

Q104: On August 1 of the current year,

Q105: At the end of the fiscal year,

Q106: The pre-adjustment net income for a company

Q107: Which one of the following adjustments increases

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents