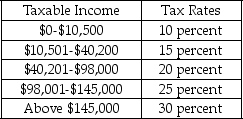

The table below shows the tax brackets for different income groups in a country:

-Refer to the table above.If Jack has an annual income of $40,000,into which tax bracket does he fall?

A) 10 percent

B) 15 percent

C) 23 percent

D) 30 percent

Correct Answer:

Verified

Q50: The federal government relies on _ to

Q51: The average tax rate faced by an

Q52: In a progressive tax system,_.

A) the average

Q53: The marginal income tax rate is the

Q54: Joseph earns $75,000.If his average tax rate

Q56: Which of the following programs provides economic

Q57: Mr.Smith pays $20,000 annually in tax.If his

Q58: The state governments in the United States

Q59: The two biggest items of spending for

Q60: Which of the following accounts for the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents