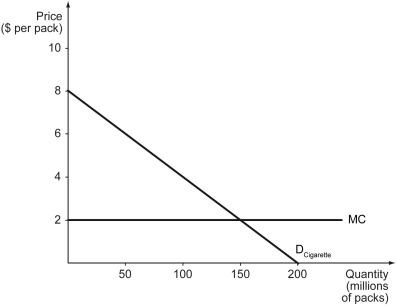

Scenario: Tobac Co. is a monopolist in cigarette market in Nicotiana Republic where the U.S. dollar is used as its official currency. The firm faces the demand curve shown below. The firm has a constant marginal cost of $2.00 per pack. The fixed cost of the firm is $50 million. To answer the questions below, it is useful to know that the equation of the (inverse) demand curve is P = 8 - 0.04Q, where Q is the quantity demanded (in millions of packs) and P is the price per pack (in $) . Also, you should draw in the marginal revenue curve.

-Refer to the scenario above.When Tobac Co.'s profit is maximized,the deadweight loss is ________.

A) $140.5 million

B) $125 million

C) $112.5 million

D) $100 million

Correct Answer:

Verified

Q232: Perfect price discrimination is also referred to

Q233: Which of the following statements explains why

Q234: Perfect price discrimination occurs when a firm

Q235: Buyers who buy in bulk are often

Q236: Which of the following statements is true?

A)

Q238: When firms charge different prices to different

Q239: A certain amusement park offers a 50

Q240: Firms that provide services (e.g.,haircuts,landscaping,medical care,and dental

Q241: The following figure shows the costs and

Q242: Which of the following is NOT true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents