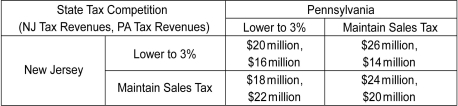

Scenario: Contiguous states often use tax policy to attract residents, firms, and economic activity. These "tax competitions" between states can be modeled with game theory. Suppose New Jersey currently has a state sales tax of 7 percent and Pennsylvania has a state sales tax of 6 percent. The game shown below models the effect of a reduction in each state's sales tax rate to 3 percent on each state's sales tax revenue. Assume the motivation of each state is to maximize tax revenue. The first number in a cell is the payoff to New Jersey; the second number is the payoff to Pennsylvania.

(Source: John Greenwald, "A No-Win War Between the States," Time, April 8, 1996, 44-45.

-Refer to the scenario above.Does New Jersey have a dominant strategy?

A) No.

B) Yes. Regardless of whether Pennsylvania decides to lower its sales tax rate, New Jersey will always gain more revenue by lowering their sales tax rate to 3 percent.

C) Yes. Regardless of whether Pennsylvania decides to lower its sales tax rate, New Jersey will always gain more revenue by maintaining their sales tax rate at 7 percent.

D) Not enough information is provided to answer the question.

Correct Answer:

Verified

Q8: Which of the following is likely to

Q9: Scenario: Suppose two soda brands, Mountain Dew

Q10: Scenario: Contiguous states often use tax policy

Q11: A game is called a simultaneous-move game

Q12: Scenario: Contiguous states often use tax policy

Q14: Which of the following games is a

Q15: Which of the following games is not

Q16: Scenario: Contiguous states often use tax policy

Q17: Which of the following is true of

Q18: Game theory is the study of _.

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents