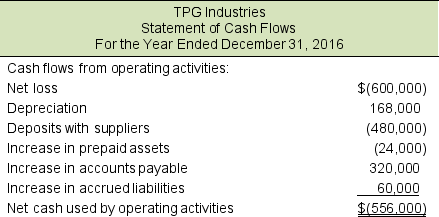

TPG Industries, a company that manufactures athletic equipment, began business in September 2016. Below is the operating section of the company's statement of cash flows. Although management has not disclosed a sales forecast, they forecast an increase in sales next year. Because of this, management plans to add $1,600,000 to inventory. However, at the end of the year, the company has less than $80,000 in cash.

You have just taken the position of financial analyst with a major investment bank. Your supervisor, John Denbear, has asked you to write a short memo about problems facing TPG. You know that losses and negative cash flow during start-up phases of businesses are common. In your memo, include discussion about the typical sources of financing that may or may not be available to support TPG's inventory expansion.

You have just taken the position of financial analyst with a major investment bank. Your supervisor, John Denbear, has asked you to write a short memo about problems facing TPG. You know that losses and negative cash flow during start-up phases of businesses are common. In your memo, include discussion about the typical sources of financing that may or may not be available to support TPG's inventory expansion.

Correct Answer:

Verified

To: John Denbear, S...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: Green St., Inc. reported the following amounts

Q50: The information below was provided by Lion

Q51: Sail Boats, Inc. provided the following information

Q52: During 2016, Donald T. Duck, Inc. issued

Q53: Construction Hats purchased equipment for $248,000 cash,

Q54: The following schedule of cash receipts and

Q55: The following schedule of information relates to

Q56: The following schedule of information relates to

Q58: Researchers have noted a reported growth in

Q59: You took a job as the new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents