Pacer Corporation acquired 80% of Slicker Company's voting stock for $36,250 on January 1, 2019. The reported equity of Slicker on January 1, 2019 was $3,000 in common stock and $9,000 in retained earnings. The fair value of the noncontrolling interest was $7,750. Slicker's assets and liabilities were reported at fair value at the date of acquisition, except for these items:

The buildings had a remaining useful life of 10 years, and the identifiable intangibles are amortized over 5 years as of the date of acquisition, both straight-line. Goodwill is impaired by $2,000 in 2019 and is unimpaired in 2020. The land, buildings, and identifiable intangibles are still held by Slicker.

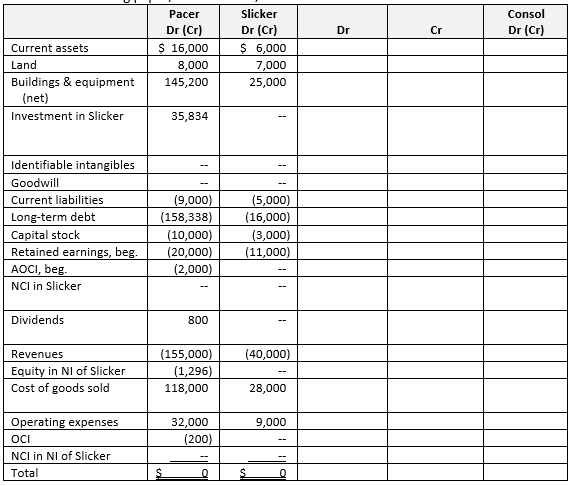

It is now December 31, 2020 (two years since the acquisition took place). The trial balances of Pacer and Slicker are in the consolidation working paper below. Information on intercompany transactions is as follows:

1. On January 2, 2019, Pacer sold Slicker equipment for a price of $800. The equipment had a book value of $300 at the time of sale, and a remaining life of 5 years, straight-line.

2. Slicker sells merchandise to Pacer on a continuing basis, at a markup of 20% on cost. Pacer's 2020 beginning inventory contains $90 in goods purchased from Slicker. Pacer's 2020 ending inventory contains $120 in goods purchased from Slicker. Total intercompany sales for 2020 were $3,000.

Required

a. Calculate the total goodwill arising from this acquisition and its allocation to the parent and to the noncontrolling interest.

b. Present a schedule computing Pacer's equity in net income of Slicker for 2020, and the noncontrolling interest in net income for 2020.

c. Complete the working paper below to consolidate the December 31, 2020 trial balances of Pacer and Slicker. Clearly label your eliminating entries (C), (I), (E), (R), (O), and (N).

d. Present the consolidated financial statements for 2020, in good form.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: Percy Footwear acquired all the voting stock

Q100: On January 1, 2018, Perfect Footgear acquired

Q101: Petersen owns 80% of Seavoss, acquired

Q102: You are consolidating the trial balances

Q103: On January 1, 2019, Petra Company

Q104: On January 1, 2016, Precision Company acquired

Q105: Porter Company acquired 100% of the

Q107: On January 2, 2017, Palace Shoes acquired

Q108: Pesto Company consolidates its subsidiary, Salsa. Information

Q109: Palmer, a U.S. company, acquired 90%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents