Price Company acquired 80% of Supervalu Corporation's stock for $700 million in cash on January 1, 2020, when Supervalu Corporation's book value was $550 million. The fair value of the noncontrolling interest was $100 million at the date of acquisition. Price uses the complete equity method to account for the investment on its own books.

At the time of acquisition, all of Supervalu's assets and liabilities were reported at amounts that approximated fair value, except for unreported identifiable intangible assets with a fair value of $500 million. These intangibles are appropriately recorded as assets per ASC Topic 805, and have a remaining life of 5 years, straight-line.

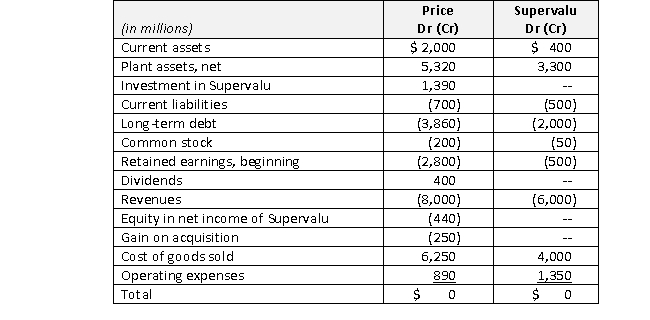

It is now December 31, 2020, and you are preparing the consolidated financial statements. The separate trial balances of Price and Supervalu are below.

Required

Required

a. Calculate the gain on acquisition for this bargain purchase.

b. Calculate equity in net income of Supervalu for 2020, as reported on Price's separate books, and noncontrolling interest in net income of Supervalu for 2020, as reported on the consolidated income statement.

c. Calculate the December 31, 2020 investment balance on Price's separate books.

d. Prepare a working paper to consolidate the trial balances of Price and Supervalue at December 31, 2020.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Phantom Casinos bought 65% of Simpson

Q103: Panerai acquired 65% of Stefanel's voting

Q104: Pebble Hotels uses a financial entity

Q105: Pearl Corporation acquires 75% of the

Q106: Packer Company acquired 75% of the

Q108: Pergo Hotels, headquartered in Portugal, issued 2,500

Q109: P&G, headquartered in Belgium, acquires 90%

Q110: On January 2, 2019, Pelletier Hotels, headquartered

Q111: Here are excerpts from the consolidated financial

Q112: Palm acquired 80% of the voting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents