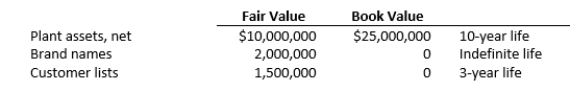

Pacific Corporation acquired all of the voting stock of Seagate Inc. at an acquisition cost of $500 million on January 1, 2020. Seagate's book value at the date of acquisition was $90 million, consisting of $10 million in capital stock, $85 million in retained earnings, and $5 million in treasury stock. Seagate's identifiable net assets were revalued as follows:

During 2020, Seagate reported net income of $6,000,000 and declared and paid dividends of $1,000,000. Seagate does not report any other comprehensive income. The brand names were impaired by $200,000. Pacific reports its investment in Seagate on its own books using the complete equity method.

During 2020, Seagate reported net income of $6,000,000 and declared and paid dividends of $1,000,000. Seagate does not report any other comprehensive income. The brand names were impaired by $200,000. Pacific reports its investment in Seagate on its own books using the complete equity method.

Required

a. Calculate equity in net income for 2020, reported on Pacific's books.

b. Prepare eliminating entries (C), (E), (R) and (O), to consolidate the trial balances of Pacific and Seagate at December 31, 2020. Assume all revaluation write-offs are reported as adjustments to operating expenses.

Correct Answer:

Verified

Q88: A subsidiary is acquired on January

Q89: Pointer Company acquired the voting common

Q90: Prairie Inc. pays $25,000 for the

Q91: Pronto Communications acquired the voting stock of

Q92: On January 1, 2020, Panadrone Inc. acquired

Q94: Photec Corporation acquires the voting stock of

Q95: A parent acquired the voting stock of

Q96: On January 1, 2019, Penn Corporation acquired

Q97: Prism Corporation acquires the voting stock of

Q98: Prism Corporation acquires the voting stock of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents